Medicare Part C

Medicare Advantage

Medicare Part C refers to Medicare health plans or ‘Medicare Advantage’ plans (formerly known as Medicare Choice+ Plans) offered by Medicare-approved private companies that must follow rules set by Medicare. These plans incorporate your Medicare Part A, Medicare Part B, and often Medicare Part D – Prescription Drug coverage – into one plan. Private insurance companies contract with Medicare to offer Medicare Advantage (MA) plans. If you enroll in a Medicare Advantage plan, you still have Medicare – however the insurance company pays your claims, not Medicare. Medicare pays a private insurance company to provide your healthcare coverage with a Medicare Advantage plan. These plans must, at minimum, provide the same level of coverage as Original Medicare (Part A and Part B). Medicare Advantage plans often include additional benefits not offered by Original Medicare.

Important MA Plan Facts

- You must have enrolled in Part A & Part B and continue to pay the Part B premium.

- You must reside in the service area of the plan you select.

- You may not have a Medicare Advantage plan and a Medicare Supplement insurance plan at the same time.

- You can only join or leave a Medicare Advantage plan at certain times during the year.

- Insurance companies sponsoring Medicare Advantage plans are paid directly by Medicare to assume full responsibility for your health care.

- Medicare Advantage plans out-of-pocket costs vary—plans may have lower or higher out-of-pocket costs for certain Medicare-approved services.

- Medicare Advantage plans cannot adjust what they charge based on the member’s age, health, or claims experience.

- Medicare Advantage plans are closely monitored, and each plan must be approved annually by the Centers for Medicare & Medicaid Services (CMS) before being marketed during the Medicare Annual Enrollment Period (AEP).

Understanding Medicare Advantage Plans

- In most cases, you’ll need to use healthcare providers who participate in the plan’s network. Some plans offer out-of-network coverage but out-of-pocket costs vary.

- Medicare Advantage plans may have lower or higher out-of-pocket costs for certain services.

- People who already have a Medicare Advantage plan will receive an “Annual Notice of Coverage” (ANOC) letter and an “Evidence of Coverage” (EOC) letter from their Medicare Advantage plan before the start of the Medicare Annual Enrollment Period (AEP). Medicare Advantage members are strongly encouraged to carefully review these letters

- The ANOC letter: Includes any changes in coverage, costs, service area, and more that will be effective starting in January. Your plan will send you a printed copy by September 30.

- The EOC Letter: Gives you details about what the plan covers, how much you pay, and more. Your plan will send you a notice (or printed copy) by October 15, which will include information on how to access the EOC electronically or request a printed copy.

Most healthcare providers only accept a limited number of Medicare Advantage plans, so patients are strongly encouraged to confirm which Medicare Advantage plans their healthcare providers accept before applying for coverage. Luckily, MedicareCompareUSA is here to help! Call the Helpline toll-free at 866-391-7763, TTY 711 (M-F 9am-5pm) to speak to a licensed insurance agent who is specially trained to help you understand your Medicare options, or request assistance here: medicarecompareusa.com/speak-with-an-agent

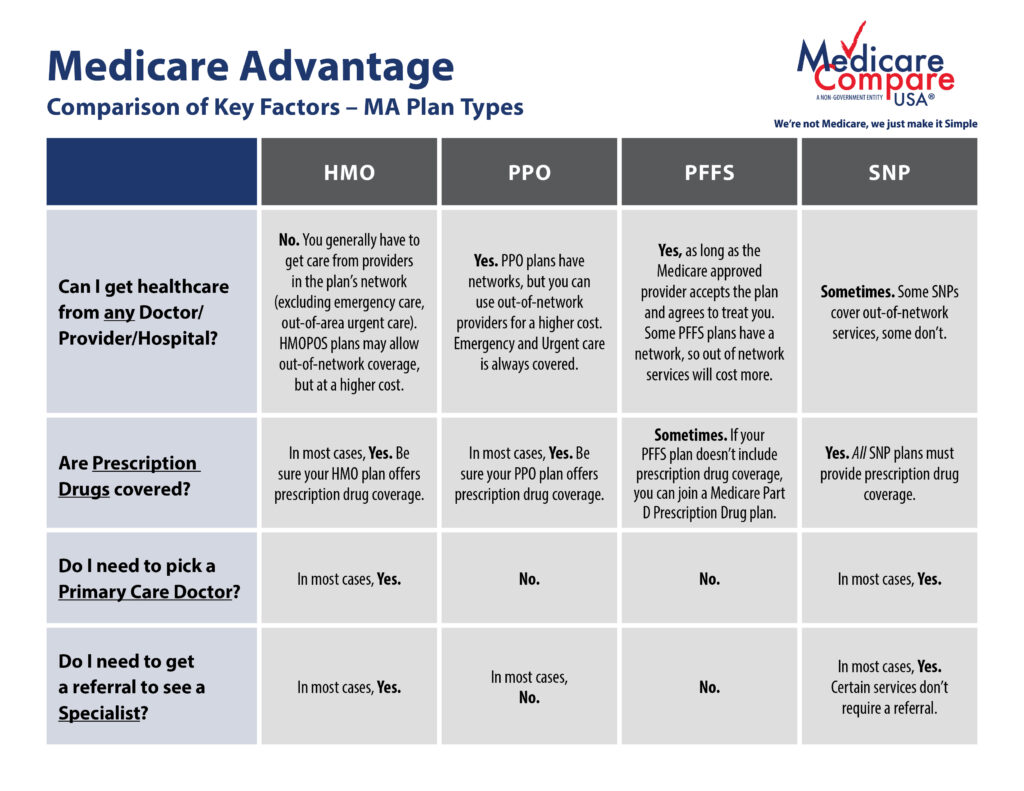

What are the different types of Medicare Advantage Plans?

- Health Maintenance Organization (HMO) plans: HMOs are a type of health insurance plan that usually limits coverage to care from doctors who work for or contract with the HMO. It generally won’t cover out-of-network care except in an emergency. An HMO may require you to live or work in its service area to be eligible for coverage.

- If your doctor or other healthcare provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network.

- If you get healthcare outside the plan’s network, you may have to pay the full cost.

- It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

- If you need more information than what’s listed on this page, check with your HMO plan carrier.

- HMO Point-of-Service (HMOPOS) plans: There are HMO plans that may allow you to get some services out-of-network but you may have to pay more.

- You don’t typically need a referral to see a specialist, but your doctor can sometimes help you get in to see one more quickly.

- The HMO and POS portions of the plan have separate deductibles. Care you receive in-network through the HMO has a different deductible and out-of-pocket limit than care you receive out-of-network through the POS. The two deductibles and out-of-pocket limits cannot be combined – they must be reached separately.

- Preferred Provider Organization (PPO) plans: PPOs are a type of health plan that contracts with medical providers, such as hospitals and doctors, to create a network of participating providers. You often pay less if you use providers that belong to the plan’s network. You can use out-of-network doctors, hospitals, and providers for an additional cost.

- Because certain providers are “preferred” they may be more affordable by using them.

- You do not need a referral to see a specialist.

- You do not need to choose a Primary Care Physician.

- PPO networks are generally larger than HMO networks.

- Private Fee-for-Service (PFFS) plans:

- The plan decides how much you pay for services. The plan will detail your costs in the “Annual Notice of Change” (ANOC) and “Evidence of Coverage” (EOC) documents each year.

- Some PFFS plans contract with a network of providers who agree to always treat you, even if you’ve never seen them before.

- Out-of-network doctors, hospitals, and other providers may decide not to treat you, even if you’ve seen them before.

- In a medical emergency, doctors, hospitals, and other providers must treat you.

- Special Needs Plans (SNPs): A Special Needs Plan provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and prescription drug formularies to best meet the specific needs of the groups they serve.

- Three groups are eligible to enroll in a SNP –

- Individuals who live in places like nursing homes or need nursing care at home (also called I-SNPs, or Institutional SNPs)

- Individuals who are dual eligible for both Medicare and Medicaid (also called D-SNPs, or Dual Eligible SNPs).

- Individuals who have chronic severe or disabling medical conditions (such as diabetes, End-Stage Renal Disease, HIV/AIDS, chronic heart failure, or dementia) These plans are also called C-SNPs or Chronic condition SNPs.

- A SNP provides benefits are targeted to its members’ special needs, including care coordination services.

- Three groups are eligible to enroll in a SNP –

- Medical Savings Account (MSA) Plans: These plans combine a high-deductible health plan with a bank account that the plan selects. The plan deposits money into the account (usually less than the deductible). You can use the money to pay for your healthcare services during the year. MSA plans don’t offer Medicare prescription drug coverage. If you want prescription drug coverage, you have to join a Medicare Part D Prescription Drug plan.

Why are Medicare Advantage Plans a popular choice?

- Most Medicare Advantage (MA) plans include prescription drug coverage, but not all.

- An annual out-of-pocket max for Medicare-approved services (Original Medicare does not have an out-of-pocket max).

- Plans may cover additional benefits such as routine vision exams, eyewear, preventative dental, ask-a-nurse, transportation, mail-order program, gym memberships, etc. Medicare Advantage plan benefits vary by plan, so carefully review the Summary of Benefits associated with any Medicare Advantage plan you may be considering.

- You can join a Medicare Advantage plan even if you have a pre-existing condition.

Medicare Advantage Coverage Questions

What if I have other coverage?

Talk to your employer, union, or other benefits administrator about their rules before you join a Medicare Advantage Plan. In some cases, joining a Medicare Advantage Plan might cause you to lose your employer or union coverage for yourself, your spouse, and/or dependents, and you may not be able to get it back. In other cases, if you join a Medicare Advantage Plan, you may still be able to use your employer or union coverage along with the Medicare Advantage Plan you join. Your employer or union may also offer a Medicare Advantage retiree health plan that they sponsor.

How do I know what’s covered?

You can get a decision from your plan in advance to see if a service, prescription drug, or supply is covered. You can also find out how much you’ll have to pay. This is called an “organization determination.” Sometimes you have to do this as prior authorization for the service, prescription drug, or supply to be covered. You, your representative, or your doctor can request an organization determination. You also have the option to ask for a fast decision, based on your health needs. If your plan denies coverage, the plan must tell you in writing, and you have the right to an appeal. If a plan provider refers you for a service or to a provider outside the network, but doesn’t get an organization determination in advance, this is called “plan directed care.” In most cases you won’t have to pay more than the plan’s usual cost sharing. Check with your plan for more information about this protection.

Do Medicare Advantage plans always include Prescription Drug coverage?

You usually get prescription drug coverage (Medicare Part D) through the Medicare Advantage plan. In certain types of plans that can’t offer prescription drug coverage (MSA plans) or choose not to offer prescription drug coverage (certain PFFS plans), you can join a stand-alone Medicare Part D Prescription Drug plan. If you’re in a Medicare Advantage HMO, HMOPOS, or PPO, and you join a stand-alone Medicare Part D Prescription Drug plan, you’ll be disenrolled from your Medicare Advantage plan and returned to Original Medicare.